Rewards4Earth MAAS has the potential to qualify as a deduction for prepaid expense under the ’12-month rule’. If you are a small business entity or would be a small business entity if the aggregated turnover threshold was $50 million, or an individual incurring deductible non-business expenditure you can claim an immediate deduction. You can claim the deduction under the 12-month rule for prepaid expenditure if:

• the payment is incurred for an eligible service period not exceeding 12 months

• the eligible service period ends in the next income year.

If the 12-month rule does not apply, your deduction for prepaid expenditure is apportioned over the eligible service period or 10 years, whichever is less.

For more information on deductions for prepaid expenses visit the Australian Tax Office website.

Rewards4Earth MAAS has the revolutionary capability of producing residual income while simultaneously rewarding clients.

Residual income occurs when a Business’ sign up at the Ambassador level. As an Ambassador, when clients you have signed up to the Rewards4Earth and start using the system, you will receive residual income from every purchase the client you signed up makes.

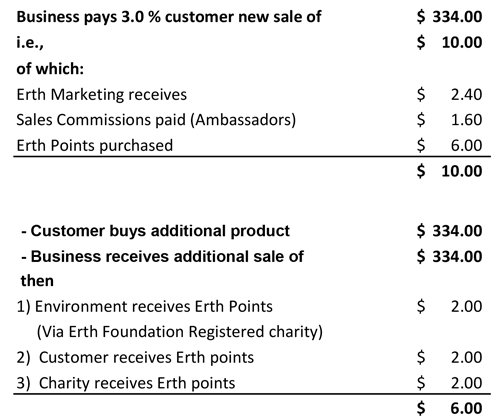

Rewards4Earth helps businesses make more sales and save on marketing costs. Every time an Ambassador registered supporter (client/customer) makes a purchase from a participating business, that Supporter, the Ambassador, their nominated Environmental and/or Community Organisation (ECO) and the Rewards4Earth Foundation, each receives Erth Points..

To attract supporters of ECO’s, businesses allocate some of their marketing budgets to Erth Points on a PAY-per-SALE basis rather than PAY-per-CLICK. Supporters register in the App, nominate their favourite ECO and register their payment card, which is tokenised; a form of highly secure encryption for the supporters’ peace of mind.

Once a sale is completed, Erth Points are transferred to the Supporter, the Ambassador, the ECO, and the Rewards4Earth Foundation. This process is automated and powered by patented technology. Businesses get access to free advertising and marketing tools and other benefits, such as being visible to potential customers looking for a product or service.

Erth Points are held by consumers in electronic wallets on their smartphones. This enables the Supporter to accumulate Erth Points from any participating business worldwide. Once earned, the customer owns them, not the business that gifted them, unlike other reward points.

The ECO’s turn their Erth Points into local currency on the exchange, selling them to the businesses that want to attract supporters.